Consumers' retail credit card spending overtakes cash

Posted on in Cycles News

A new report by a retailers' trade body has said that consumers have spent more money on credit cards with UK retailers in 2018 than they did in cash.

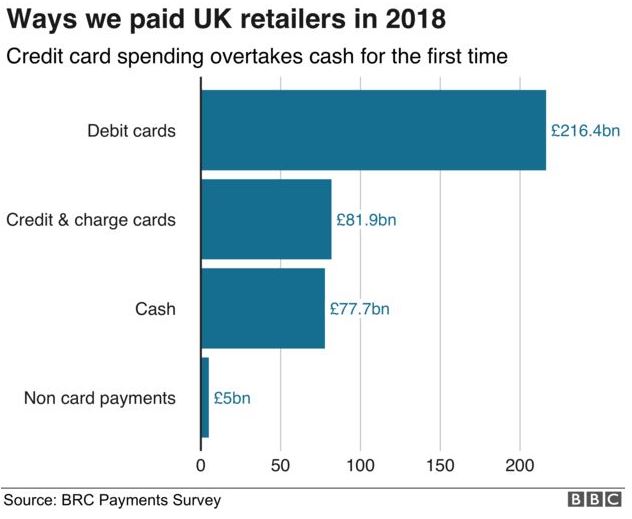

The chart below shows a payment survey undertaken by the British Retail Consortium (BRC) which shows that debit cards remained to be the form of payment with most money being spent through it, accounting for £216.4bn of sales, whilst cash dropped to the third most popular at ££77.7bn. Credit and charge cards accounted for £81.9bn, or 22%, of retail sales last year - outstripping cash for the first time in the last 20 years of BRC payment surveys.

However, cash was actually still used more frequently than credit cards, although the typical transaction using cash was worth over £20 less than the average credit card payment of £31.54. Cash accounted for just over £1 in every £5 spent with UK shops.

The BRC argued that rising costs faced by retailers to process card payments could push up prices. Andrew Cregan, policy adviser at the BRC, said that falling cash use and growth of online shopping were both factors in the shift. A cashless society is cause for concern for vulnerable people, such as those with physical or mental health problems, who find it hard to use digital services, people who have been bankrupt, or those who use cash as a lifeline when in difficult or abusive relationships, could also be severely affected.

Despite this, the BRC outlined their main concern to be for retailers and the cost of accepting card payments. The BRC stated that the average cost faced by a retailer for a debit card transaction was 6.23p, rising to 18.19p for credit or charge cards, compared with 1.66p for cash, and these costs continue to rise sharply.

Card Processing with ActSmart

ActSmart offer two card processing options; Global Payments for established businesses with medium to high card turnover and Paya Card Services for new and smaller businesses with lower card volumes.

Global Payments

Global Payments is ideal for established or larger businesses that will save you save you time & money in-store, online and through mail order. Credit card rates start from 1.090% and debit card rates start from 0.29%. The offer also includes a free set-up worth £150 and three months free terminal rental.

Paya Card Services

Paya Card Services is ideal for start-ups and small businesses. Features include a pay-as-you-go account with a fixed, all-inclusive rate with no additional fees, including PCI. It also offers in-store, online, mail order and mPOS solutions with no minimum contract term and no monthly minimum charge. The offer also includes a free sign-up worth £99 and an optional discounted countertop terminal just £1.75 p/w.

For more information about either of the ActSmart card processing partners please visit the ActSmart website.

Useful links

If you have any other queries please contact us.